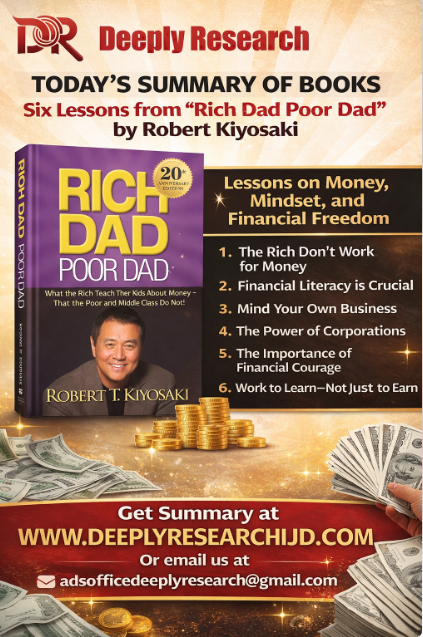

Introduction

Rich Dad, Poor Dad by Robert T. Kiyosaki is a groundbreaking personal finance book that challenges traditional beliefs about money, education, and success. First published in 1997, the book uses the contrasting life philosophies of two father figures Kiyosaki’s biological father (the “Poor Dad”) and the father of his childhood friend (the “Rich Dad”) to explain why some people struggle financially while others achieve lasting wealth. Through simple storytelling and practical lessons, Kiyosaki argues that financial success depends not on how much money one earns, but on financial education, mindset, and the ability to make money work for you.

The Concept of Two Dads

The foundation of the book rests on the idea that Kiyosaki was influenced by two fathers with opposing views on money. His Poor Dad was highly educated, held a secure government job, and believed strongly in formal education, job security, and stable income. Despite earning a good salary, he struggled financially throughout his life. In contrast, Rich Dad had little formal education but possessed strong financial intelligence. He built businesses, invested wisely, and accumulated significant wealth.

This contrast allows the reader to see that intelligence and education alone do not guarantee financial success. Instead, the way one thinks about money, risk, and opportunity plays a more decisive role.

Lesson One: The Rich Don’t Work for Money

One of the book’s most powerful ideas is that the rich do not work for money; instead, they make money work for them. Most people spend their lives working for salaries, depending on jobs to survive. According to Kiyosaki, this creates fear ,fear of losing a job, fear of not earning enough, and fear of taking risks.

Rich Dad teaches that dependence on wages traps people in the “rat race,” a cycle where income increases but expenses rise even faster. The wealthy, however, focus on acquiring assets businesses, investments, and income-producing opportunities that generate money without constant labor.

Lesson Two: The Importance of Financial Literacy

Kiyosaki emphasizes that financial literacy is the key difference between the rich and the poor. Schools teach academic and professional skills but rarely teach how money works. As a result, many well-educated professionals doctors, lawyers, and accountants still struggle financially.

Financial literacy includes understanding income statements, balance sheets, assets, liabilities, and cash flow. Rich people understand how money flows and make decisions based on long-term financial impact rather than short-term comfort.

Assets vs. Liabilities

A central concept in the book is the difference between assets and liabilities. Kiyosaki defines an asset as something that puts money into your pocket, while a liability takes money out. Many people mistakenly believe their house or car is an asset, but if it requires ongoing expenses without generating income, it is a liability.

The wealthy focus on building assets such as rental properties, businesses, stocks, and intellectual property. Over time, these assets generate passive income, reducing dependence on active employment.

Lesson Three: Mind Your Own Business

Kiyosaki encourages readers to focus on building their own financial foundation rather than relying solely on employers. While having a job can provide income, true wealth comes from owning assets outside of employment.

“Mind your own business” does not mean neglecting your job; it means using earned income to acquire assets. Rich people dedicate time to learning, investing, and entrepreneurship, steadily increasing their financial independence.

Lesson Four: Taxes and the Power of Corporations

The book also explains how tax systems favor the wealthy, not because of unfairness, but because of knowledge. Corporations allow business owners to reduce tax burdens legally through deductions and reinvestment strategies. Employees, on the other hand, pay taxes before receiving their income.

Kiyosaki argues that understanding tax laws and business structures is crucial. The rich are not tax evaders; they are tax-smart. This lesson highlights the importance of financial education over emotional reactions to inequality.

Lesson Five: The Rich Invent Money

Another key idea is that money is created through ideas and opportunities. Rich Dad teaches that wealth is not limited to physical currency; it comes from creativity, innovation, and problem-solving. Financial intelligence allows individuals to see opportunities where others see obstacles.

This lesson encourages risk-taking, learning from failure, and developing confidence. Fear of making mistakes often prevents people from taking action, while the rich view mistakes as valuable lessons.

Lesson Six: Work to Learn, Not Just to Earn

Kiyosaki advises readers to focus on learning skills rather than chasing high salaries. Many people stay in unfulfilling jobs because of financial security, but this limits personal growth. The rich seek knowledge in sales, marketing, leadership, and investing skills that apply across industries.

By working to learn, individuals gain versatility and adaptability, which are crucial in a rapidly changing economy.

Mindset and the Power of Thought

Beyond financial strategies, Rich Dad, Poor Dad strongly emphasizes mindset. Kiyosaki shows how language and beliefs shape financial behavior. For example, saying “I can’t afford it” shuts down thinking, while asking “How can I afford it?” encourages creativity and problem-solving.

The book highlights how fear and greed control most people’s financial lives. Rich individuals learn to manage emotions, think long-term, and make decisions based on logic rather than fear.

Criticism and Practical Impact

While the book has been criticized for oversimplifying economics and lacking detailed investment guidance, its true value lies in changing how readers think about money. It does not offer a step-by-step formula to get rich but instead provides a mental framework for financial independence.

For students, young professionals, and entrepreneurs, the book serves as an introduction to financial awareness and self-education.

Conclusion

Rich Dad, Poor Dad challenges conventional wisdom about success, urging readers to rethink education, work, and money. Through the contrast of two fathers, Robert Kiyosaki demonstrates that wealth is built through financial literacy, mindset, and asset ownership rather than job security alone.

The book’s enduring message is clear: financial freedom is achievable for anyone willing to learn, think differently, and take responsibility for their financial future. In a world of economic uncertainty, Rich Dad, Poor Dad remains a powerful call to escape the rat race and build lasting wealth through knowledge and discipline

Breaking the Rat Race: Lessons on Money, Mindset, and Financial Freedom from Rich Dad, Poor Dad

Comments

most of us WE ARE Poor Dady

Thank you

Good 🙏